Stress Less: Here’s How To Save For BAS

If you break out in a cold sweat every quarter wondering how you’re going to pay your BAS, you need to keep reading. There is a simple solution that doesn’t require nerve-wracking, lump-sum payments or hard-to-follow saving plans. Stay with me because a few tweaks here and there is all it takes to stay ahead of the BAS game.

Analyse Your Income

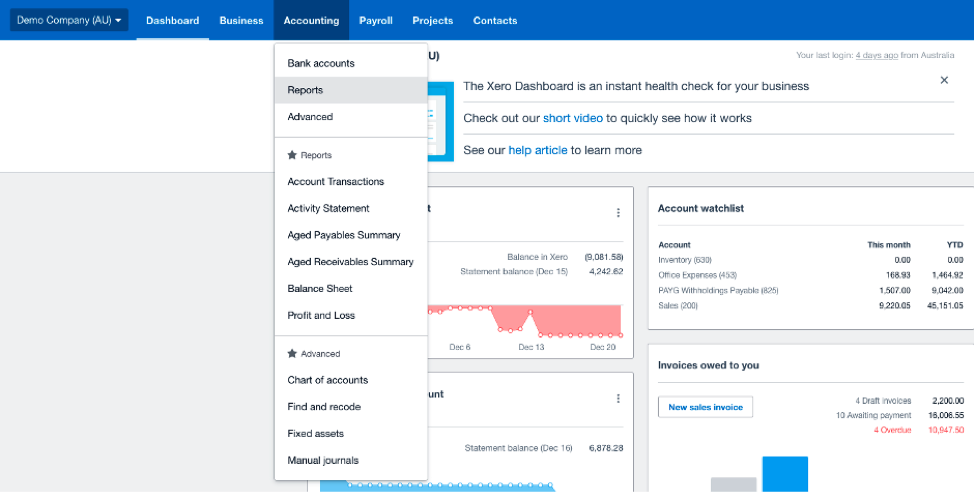

You can’t plan if you don’t know your numbers so step one is to grab your total income for the last week or month – whichever frequency works best for you. You can do this by logging into Xero and running your profit & loss to see your sales – which are of course excluding the GST amount.

Do The Sums

We’re going to keep this simple and look at monthly!

Let’s say your income for the month came to $50,000. Then we’ll assume you have no deductions (to keep it easy) and say you’ll need 10% put aside which is $5,000 for that month.

Income $50,000

Times 0.1

= $5,000

And there you have it, a nice round figure to work with.

Automate Your Money

If the thought of saving $5,000 per month is making you squirm, fear not because this process is painless when it’s broken down.

Set-up a separate GST Savings bank account

Organise monthly to transfer the amount you worked out above (or you can work on weekly reports and savings)

Don’t touch the account!

Don’t bank on GST Claims

You may be wondering why I haven’t spoken about the deductions – you’ll no doubt reduce your BAS amount?

The reason is simple: you’re better to have too much in the kitty rather than not enough.

If you do have loads of expenses with GST – you can if you prefer run your draft Activity Statement to get the net amount to save, but this is only as accurate and up to date as your processing.

So instead, go with the 10% of sales to stay in the green and rejoice when you have a bit of fat in the bank balance!

Get your bookkeeper on board

If you have a bookkeeper on the tools, the great news is they can take all of the above (and more!) off your plate. Get your bookkeeper to run reports, estimate your BAS and more.

Imagine having no bad BAS vibes?!

If you are running your business without the support of a bookkeeper in the know and you’re ready to take the next step, I know of a good one!

I specialise in supporting female-led businesses and would love to hear more about yours. Check out my services and once you’ve found the right one for you, book a discovery call with me.

Yours in making BAS bills easy,