How To Calculate (and track!) Your Expenses

Everyone wants to turn a profit in business but here’s the thing, making money is only one half of the coin. Spending money is the other. Keeping a close eye on your outgoings is crucial to growing your business.

But how do you do it properly?

Unfortunately, there’s no ‘hack’ or ‘set and forget’ automation but, there are ways to simplify the process! And, more importantly, streamline it. That way you won’t be floundering through Tax & BAS season and, you’ll have a reliable system to keep the momentum going.

Track EVERY business expense

Don’t forget to track every business expense! I see so many missed ones and it all impacts your bottom line. A $5 notebook here, a forgotten subscription or insurance premium there and before you know it, you’ve missed $1,000 worth of tax deductions.

This will look different for every business owner but to give you an idea, common business expenses include:

- Marketing & Advertising: contractor fees, advertising spend, social media costs

- Subscriptions & Software: Klaviyo, Xero, Planoly, Canva

- Bank Fees: AfterPay, Stripe, Shopify, ZipMoney

- Utilities: Business Insurance

- Web: website and email hosting, domain registratio

Get a definitive list together and start tracking!

*Reminder: a business expense can only be claimed when it is an actual business expense. If only a portion of the fee was related to business, you can only claim a % of that expense.

Keep records of EVERY business expense

So something you may not know is that the ATO requires you to keep accurate records dating back five to seven years. As a bookkeeper, I won’t submit an expense without seeing the receipt first. Yup, it’s that serious.

You’ve got two options:

- Save paper copies of all receipts and physically store them.

- Save digital copies of all receipts and store them in the cloud

I would urge you to choose option 2. If you’re nodding your head, let me introduce you to HubDoc!

This software captures all of your expenses and automates your data entry and document storage. The good news is, that this platform is owned by Xero and integrates seamlessly. And, it’s 100% free on all business plans.

It’s really simple to use too. Take a photo of your receipt, upload it and link your accounts for fuss-free integration.

Make life easy by syncing all of your records with Xero.

Code every business expense

If I had a dollar for the amount of Xero files I’ve opened only to find most expenses lumped in ‘general expenses’ I’d be a very rich lady. General expenses should be banned in my humble opinion.

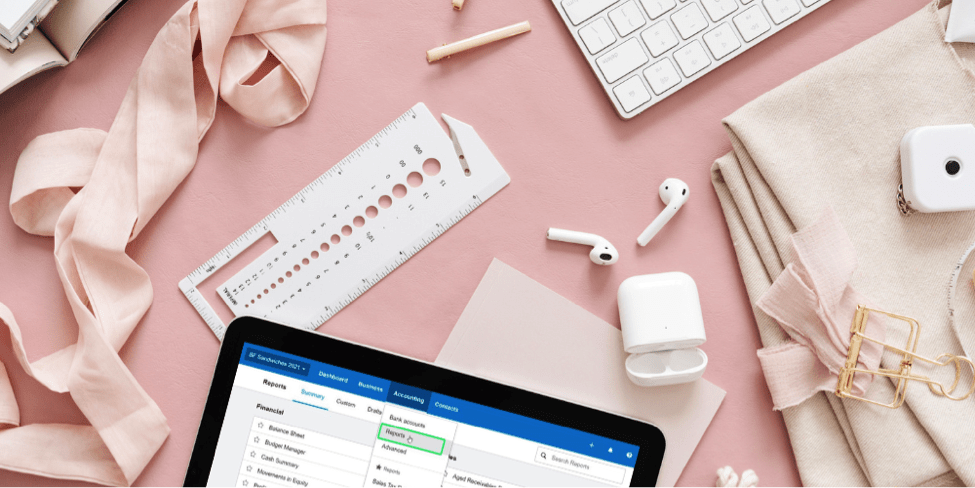

Instead, set up expense codes for your common expenses. That way, you can pull reports and see exactly where you’re spending. And then? You can make informed decisions!

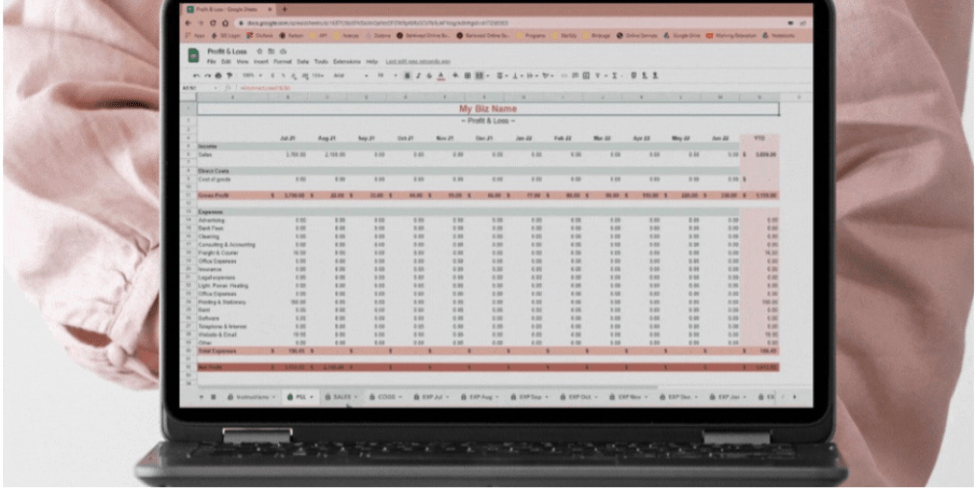

You can use a trusty spreadsheet (I’ve got a free Profit & Loss Generator for that very purpose) but accounting software makes it simple and is always my strong and firm recommendation! You can do your invoicing, send receipts and record your expenses like a pro. There’s even an app so you can do it on the go!

Calculate your business expenses

Now that you’ve got accurate records of every business expense and they’re coded in the right place, you can calculate and report on them. Woohoo!

You’ll want to view your expenses in different report styles based on the reason you’re looking into them. Here’s how I pull reports based on circumstance.

Weekly Expenses

Pulling a weekly report on all expenses enables you to cross-check what you’ve spent vs what your bank is telling you. Once you get into the habit of this, you’ll realise how much room there is for error and you’ll be able to fix it on the spot.

Monthly Expenses

I pull monthly expense reports for a more strategic overview of the business. From here, I can see what the operating expenses are and pulse-check how net profit is tracking.

Expenses By Type

Ever wondered how much you’re really spending on Facebook Ads per year? I pull expense-by-type reports to help my clients make informed business decisions. For example, how does this cost compare to other marketing activities? Pull a sub-total by category and see for yourself!

Sifting through expenses by type can be a monthly, quarterly or even bi-annual activity but make sure you do it!

My top tip? Create a sustainable system for calculating and tracking your expenses. It may not seem as fun as counting income but your business won’t fly without the right financial info!

Not keen to do it yourself? Get me on the tools and I can do all of the above (and SO much more) for you. Check out my services and book a call so we can get the numbers ball rolling.

In the meantime, you might find these articles useful:

- Bookkeeping Tips For The Self Employed

- Xero Made Easy For eCommerce

- Stop What You’re Doing And Customise Your Chart Of Accounts

- Expense Coding: How To Do It Right

- Top Tips For EOFY

- Your Important Profit & Loss Questions Answered