Can I Claim GST On All The Things?

GST – Goods & Services Tax. It’s such a boring topic hey. Well as a small business owner, this is something you still need to be all over and understand. Or get a fab BAS Agent…

So you’re here to learn the basics around if you can claim GST or not. Let’s see!

You are not registered yourself

First question – are YOU registered for GST? If not then it’s a super simple no. You can skip straight over to the what should a tax invoice look like.

If you’re not registered, it doesn’t matter what you purchase and if there is GST on the suppliers invoice, you can’t claim it or enter it anywhere, it’s just not relevant to you. If you’re using accounting software, just put it through with the code BAS Excluded (Xero) N-T (MYOB) or what ever your equivalent is.

Don’t even split your expense into two lines, one for the $100 printing and stationery, one line for $10 to GST. It’s just a flat out expense of $110 to printing and stationery. You can just pretend GST doesn’t exist! Might sound funny, but believe me I’ve seen this happen many times. There have been some super ‘creative’ entries I’ve seen them all. But it’s OK – you don’t know what you don’t know! I am here to help take away the confusion.

You DO still need to check you get a valid invoice from your supplier and that there is an ABN quoted, else it’s not a tax deductible business expense.

‘The Black Economy Taskforce…if a business pays another business that does not have an ABN, nor a valid ABN, the business will not receive a tax deduction for the payment’.

You are registered for goods & services tax

If you’re still with me, you’re registered for GST – or just keen to read all my blogs – thank you! The reason I wanted to write this blog is

- I get asked a lot of questions on invoices

- I see a lot of invoices that are not GST compliant

- people claiming GST that they shouldn’t – when there isn’t any!

- to help people learn more to help their business

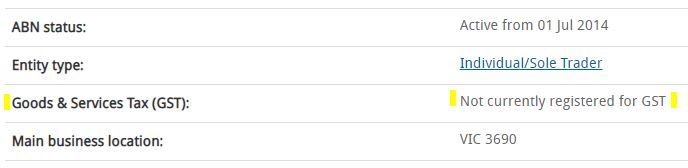

First up – ensure you have a valid tax invoice for your purchase, this will let you know their ABN and you can look up on the ABR (Australian Business Register) if they are registered for GST or not and that it is a current ABN.

What to check for – is the status Active and does the name on the invoice match the name on the register, if not does it match one of the trading names further down the page? If it does, great. If not, go back to them and say hey, you’ve quoted an ABN that doesn’t look to be related to your business, can you please check and send through an updated one. There have been many many cases where people deliberately use someone elses ABN to get away with not reporting their income. There was a huge case where tradies were quoting Bunnings ABN on their invoices!

Next – if that ABN IS registered for GST – they are required to charge you GST on all goods and services (unless it is a GST free item).

So in this instance, you can totally claim the gst on this business related expense. And if the invoice says 0% GST or GST free, just go back to them and say “Quick query, you’re registered but your invoices don’t have GST on there can you fix that up for me please” (unless it’s actually a GST free item).

If that ABN IS NOT registered for GST, doesn’t matter what they’re selling you, you can’t claim any GST on it, because there is none. You put your purchase through your software as GST Free. If that ABN is not registered and they’ve charged you GST, chances are they need to adjust their settings in their invoicing software. You are not entitled to claim that GST on their invoice as a credit. So grab a new invoice from them.

Just because you are registered for GST doesn’t mean you can claim GST on any or all expenses you have. You need to check if there is actually is any from that supplier and it varies greatly! Check them all on the Australian Business Register Lookup tool. It will become a frequently used website – I’m pretty sure it’s our most frequented web address haha!

As the business owner and the person paying the bill, it’s your responsibility to check the invoice is correct and that you’re claiming the correct GST credits. So the buck stops with you so to speak 😉 if the invoice is wrong, don’t pay it! Get an accurate and valid one before paying suppliers. You don’t want to end up having to pay back any GST you’ve claimed!

Got any questions? Jump into the Numbers Club where you can ask away and there’s loads of resources and support just for you.